Money

Lessons in pain management: How PGA Tour commissioner Jay Monahan survives the current crisis

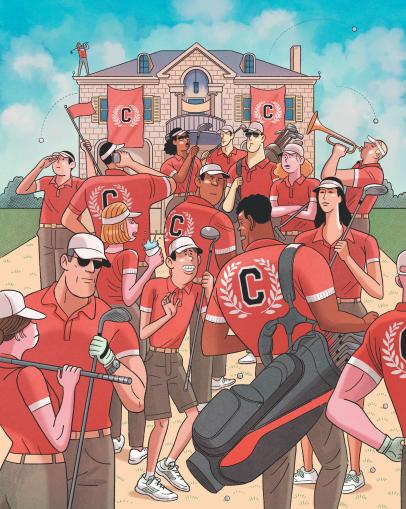

Photo by Eric Ryan Anderson

The PGA Tour has gone through what anyone would describe as two of the most challenging years in its 55 years of existence as a separate entity. Commissioner Jay Monahan has presided over a period of intense upheaval, with the loss of marquee players to LIV Golf and the controversial, combative and, ultimately, capitulating response to a wealthy new competitor. The tour secured an enormous new television deal but hemorrhaged cash, dipped into reserves and said goodbye to longtime sponsors in the fight. Dozens of players have been critical of how Monahan has handled the crisis and how he has communicated with members.

"Management has not done a good job," said reigning FedEx champ Viktor Hovland in a recent podcast. "You see what happens behind closed doors, how management actually makes decisions that are not in the players' best interest but best for themselves and what they think is best."

Hovland's assessment is the latest in a series of unflattering critiques of Monahan’s performance, but that is one perspective. If everyone agreed, one would assume Monahan’s seat in the commissioner’s office would already be vacated. Is there an avenue for him to continue after most of the chaos has been resolved? If not, why hasn’t a change been made?

One fact reinforced during the past two years is that money talks—and even in the throes of crisis, Monahan received $18.6 million in compensation in 2022, according to Sportico, which cited the tour's latest tax filing. That's nearly $5 million more than he earned in 2021, and he's presumably still leading the ongoing negotiations between the PGA Tour and LIV’s financial backer, the Public Investment Fund of Saudi Arabia, (as well as talks with other potential investors) about a new for-profit professional-golf entity comprising the PGA Tour, DP World Tour and LIV.

What does that mean for Monahan and his future at the tour? One of the least heralded but potentially most valuable aspects of a sports commissioner's job is to serve as what Lukas Matsson of the HBO series “Succession” called a "pain sponge." Monahan and counterparts like the NFL's Roger Goodell (more than $60 million in salary) and the NHL's Gary Bettman ($10 million annually) are getting paid for much more than their negotiating skills and television presence. Being the corporate face of the league means absorbing the brunt of intense internal and external blowback that comes with a crisis.

"When you have an organization that is in the entertainment business, being the leader is a super public-facing role with a lot of constituencies," says Dan Guglielmo, an executive coach and transition consultant who has worked with dozens of chief executives in turmoil. "Managing that means dealing with adversity, and one of the most significant skills of that leader is taking the heat—from everyone. That's what they get paid to do."

Goodell has navigated multiple controversies over two decades, including battles with Tom Brady over inflated footballs, dealing with former Washington Commanders owner Daniel Snyder's toxic workplace culture and the league's response to players expressing themselves during the Black Lives Matter protests. Goodell's job? To be the personification of the league in those controversies and shield the "board"—in this case, the 32 team owners—from getting rolled up in the pile. "The NFL lets Goodell stay in the fire because he has shown the ability to navigate the league through it,” Guglielmo says, “and both he and the league come through stronger."

Few sports executives were as unpopular as Bettman in 2004 when the commissioner was the face on all the highlight shows announcing that the league and players couldn't agree on a new labor contract, and the 2004-’05 season was cancelled. Bettman took a beating in the media—everyone from players to Newsweek, which anointed Bettman one of the 10 worst executives in America for the year. But while Bettman was behind the woodshed getting licked, the NHL's next labor deal reduced salaries across the board by 25 percent. Now, three teams are worth more than $2 billion, compared to $160 million in 2004.

Of course, the PGA Tour is different from the NFL and NHL in important ways beyond orders of magnitude less revenue. Goodell and Bettman answer to team owners. Monahan answers to players and a board of directors who don't have nearly the same commonality of purpose. New England Patriots owner Robert Kraft and Atlanta Falcons owner Arthur Blank might not agree on everything, but they are both billionaires with decades of experience running giant companies. Tiger Woods and Tommy Gainey might both play golf, but that's about as far as the similarities go. The NFL is in as complete control over its market as a sports league can be. The PGA Tour's future might be out of its hands given the resources available to the PIF (and its governor, Yasir Al-Rumayyan), and the U.S. government's interest in potential antitrust regulation even if a LIV deal goes through.

Whether Jay Monahan continues to lead the PGA Tour even if a deal is reached with PIF governor Yasir Al-Rumayyan remains unclear.

"It's called being a leader on the bubble, and there's a real skill to it," Guglielmo says. "The ones who are good at it are good at dealing with volatile situations. They have thick skin and they know when to say they're wrong. They're OK with risk and the fragility of the situation. They're actually excited by the prospect of going on a potentially rough ride. That's the skill set the best boards pay for. At the same time, CEOs or commissioners are the perfect scapegoats. Throw them under the bus, bring somebody new in and tell a fresh story."

It's a ride common in the business world. General Motors lost nearly $100 billion leading up to a potential bailout by the federal government in 2008 and 2009. Before the feds would consider offering the automaker a life raft, it stipulated that CEO Rick Wagoner had to resign. He quit, and 60 days later, the company had a short-term funding package in place. Fritz Henderson and Edward Whitacre were caretaker CEOs as the company sorted through the financial wreckage, and they undertook unpopular programs like slashing retiree medical benefits, reducing headcount by thousands and discontinuing legacy brands like Pontiac and Saab.

Is Monahan going to survive and thrive under fire like Goodell, or will he end up like Wagoner—the C-suite equivalent of one of those paper coverings mechanics use to protect a car's floor mats during service? That depends on how well he is able to absorb all the blows, continue to evolve in his job and do it while keeping his constituents' trust.

Tim Marken helped revitalize the Boston Globe's media business and was part of the team that increased tech consultancy Gartner's revenue from $150 million to $850 million. Now, he works with CEOs to help companies avoid stalling in the face of new competitors. "Think about how much the landscape has changed for the PGA Tour in the past two years," says Marken, who also teaches management and leadership courses at Babson College. "It went from having no competitors and a predictable playbook to being in a fight with a competitor with unlimited resources. It would be almost impossible for anyone to communicate with all the constituencies—from players to board members to the media to sponsors to fans all the way to the retired legends of the sport—in a way that responded to every person's individual outcome. The skills a leader in this situation needs are radically different. You almost have to communicate like an entrepreneur in terms of disruption and lean into that disruption because there's a competitor who’s obviously willing to disrupt, and that’s a danger even if their ideas aren't good ones."

Monahan's mission? Painting a picture of what an attractive future could look like that resonates with those disparate groups. That means sending signals inside and outside the organization about what the long-term value of the changes will be—even if there's near-term pain. "The CEOs that are able to take bullets and be confident about significant changes are the ones who are confident they understand what's happening tactically in the field and strategically in the boardroom," Marken says. "They operate with the conviction that in some shape or form, their decisions are going to pan out. Behind every one of those individuals taking those bullets is someone else who is going around and making sure that the fires don't burn out of control."