News

Costco vs. Acushnet: Who has the upper hand?

The burgeoning legal battle between Costco and Acushnet over the cult favorite Kirkland Signature ball is sounding more and more like a game of courthouse chicken.

But that can be an expensive game, with occasionally terminal consequences.

In layman’s terms, Costco’s suit for what’s called a declaratory judgment against Acushnet is essentially a preemptive strike, a lawsuit aiming to prevent a lawsuit. In actuality, it’s probably not going to work that way.

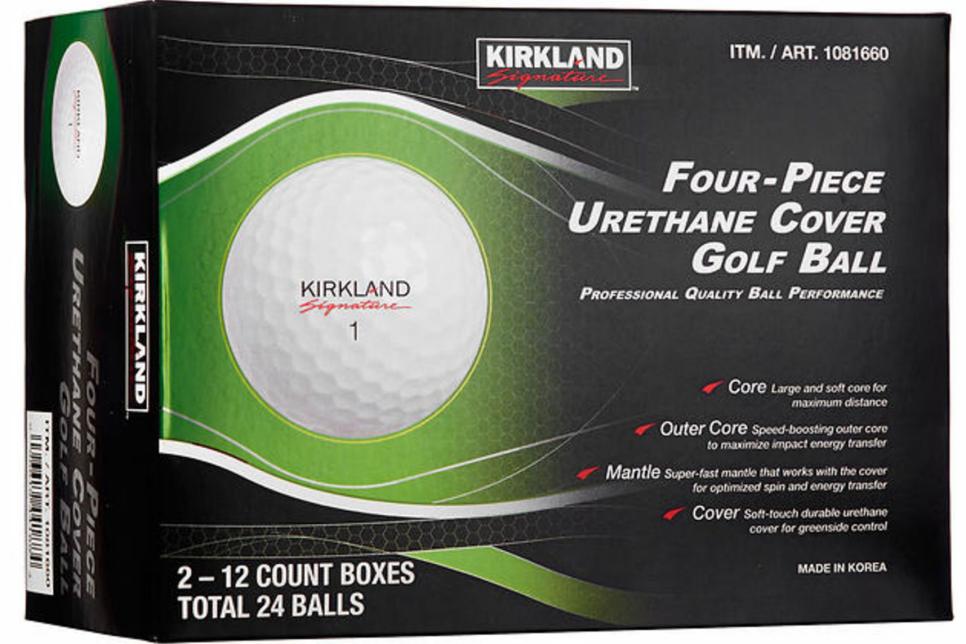

In its complaint, Costco references a “threatening letter” it received from Acushnet accusing the Kirkland Signature ball—the $15-a-dozen multilayer, urethane-cover tour-type ball that’s been a bit of a cult sensation—of violating 11 patents. Costco is asking the court to rule that the Kirkland Signature not only does not violate the 11 patents but that the 11 patents themselves are invalid.

That’s a bold ask in the world of golf ball patents, especially where Acushnet is concerned. Acushnet holds more U.S. patents in golf ball technology than any other company (more than 1,200), and its latest tour-dominant Pro V1 and Pro V1x multilayer urethane cover balls continue to rule the golf ball marketplace at nearly $50 a dozen.

Costco does not manufacture the Kirkland Signature ball. It is produced by Nassau, a vendor in Korea that works with several U.S. golf companies.

“Costco has no idea what they’re getting into with Acushnet,” said one veteran of the golf ball industry familiar with ball patents and litigation.

The golf ball patent landscape can be challenging to navigate and especially challenging to navigate against Acushnet, which in recent years has used its overwhelming and well-established patent portfolio and the legal system to quash a series of smaller ball manufacturers. It also successfully reversed a patent case with Callaway that originally went to trial in 2006 and wasn’t resolved until 2012. Its position in these matters has been unyielding, as revealed in this statement from its SEC form S-1 announcing its plans for an initial public offering last year:

“If we fail to obtain enforceable patents, trademarks and trade secrets, fail to maintain our existing patent, trademark and trade secret rights, or fail to prevent substantial unauthorized use of our patent, trademark and trade secrets, we risk the loss of our intellectual property rights and competitive advantages we have developed, which may result in lost sales. Accordingly, we devote substantial resources to the establishment and protection of our trademarks, patents and trade secrets or know-how, and we continuously evaluate the utility of our existing intellectual property and the new registration of additional trademarks and patents, as appropriate.”

In this morning's fourth quarter and fiscal year 2016 earnings call, Acushnet President and CEO Wally Uihlein declined to elaborate on the Costco case. "You know based on past experience that we never comment on the competition, and as you would expect, we don't comment on any outstanding litigation," he answered to one analyst's specific question about the impact of the Kirkland Signature ball. "We do respect the fact that you're going to ask questions of a competitive nature and of a litigious nature and hopefully catch us at a weak moment, but we'll take a pass on both of those."

So Acushnet has both the horsepower and the intellectual property to play the long ball. Indeed, now as a public company, it may have even more impetus to aggressively police its patents. But as the veteran golf ball industry observer noted, this case may be about more than the patents: “This may be a matter of principle for Costco.”

Costco’s business model is driven on finding extreme savings on quality goods for its members. Although it recently delivered disappointing second quarter sales numbers, it remains relentlessly successful, moreso than any other retailer, in pursuing its mission statement “to continually provide our members with quality goods and services at the lowest possible prices.” It’s shown that to do so it will go to court to defend that right, even if that means years worth of trials. It once went more than a decade, including an appeal to the Supreme Court, fighting for the right to sell gray-market Omega watches purchased overseas for less than what an authorized U.S. dealer was allowed to charge—and won.

According to legal experts, it seems likely that Acushnet will issue a counter claim, but for the moment, Costco does hold an advantage in its preemptive action, which was filed in the U.S. District Court’s western District of Washington at Seattle, near Costco’s headquarters in Issaquah.

“It’s a problem for the alleged infringer if the patent holder doesn’t sue them, so this does two things,” said Rochelle C. Dreyfuss, the Pauline Newman Professor of Law at New York University School of Law. “It accelerates the lawsuit, which sometimes the alleged infringer wants, and it also gives the alleged infringer a choice of court.”

Rather than let Acushnet’s so-called “threatening letter” linger, Costco decided to assert that the Kirkland Signature ball among other claims, does not infringe Acushnet patents for the relative hardness of the ball’s cores, the springiness of the core, and the dimples’ surface coverage. It also is asking the court to declare the 11 Acushnet patents invalid.

“Costco finally said ‘Screw you, you want to play this as a game? Well, we’re actually going to bring a lawsuit and now you’re going to be forced to defend a lawsuit,’” said Dreyfuss, who has co-authored books on intellectual property law and international intellectual property law.

David Dawsey, a patent attorney who studies the golf patent landscape at his website golf-patents.com and broke the news of the Costco suit, says the process in this case will be fairly direct.

“Once Acushnet files an answer [to the suit], and probably a motion to dismiss the lawsuit, Costco is likely to seek a summary judgment ruling that they don’t infringe the patents to try to dispose of the matter,” he wrote in an email.

What’s not clear is just how strong a case Costco can make in its effort to detail the invalidity of Acushnet’s patents, or whether, given its limited knowledge base in golf ball technology (the Kirkland Signature is its first private label golf ball), it can stand toe-to-toe with the industry leader. Invalidating patents is not easy and it will take a lot of time, especially when it comes to the kind of golf ball patents developed by Acushnet, the kind that have stood the test before.

Moreover, Costco has to navigate a difficult timeline. Although it’s already on record saying it will return to selling the Kirkland Signature in limited quantities next month, those sales could be problematic if it’s not granted a declaratory action, or worse if Acushnet files a counter claim. In that case, if Acushnet ends up the winner, damages would be trebled.

And therein lies the question. Although this might be “a matter of principle” for Costco, one has to wonder how much stomach it has for a protracted—and perhaps extremely costly—legal tussle with an opponent known to fight such matters to the end. For all the media hype and the cult-like status afforded the Kirkland Signature ball, fact is its contribution to Costco’s bottom line is likely no more than an accounting rounding error due to its inability to produce more than limited quantities of the ball.

Costco didn’t become a giant in retail by not knowing how to calculate return on investment and in this instance, the math might not hold up and profits could end up outweighing principle. That’s because one thing is almost certain. In a game of courthouse chicken over anything having to do with a golf ball, Acushnet would rather collide head on at full speed than be the one who swerves to the side first. Of course, when it comes to defending low prices, Costco seems just as committed.

It might not be fun to be in the middle of such a confrontation, but it ought to be fun to watch.